What Is a Payday Loan? A Modern Approach to Short-Term Credit in South Africa

Financial flexibility is no longer a luxury; it is a necessity in the modern South African economy.

As the cost of living fluctuates and unexpected expenses become more frequent, the traditional banking

sector often falls short of providing the immediate liquidity that citizens require.

This is where payday loans have stepped in, transforming from simple cash advances

into sophisticated, digital-first financial tools designed for the 2025 economic landscape.

Speed of Access

Where traditional banks take weeks, digital payday loans process applications in minutes using AI.

Financial Inclusion

We look beyond credit scores, using alternative data to provide loans to those ignored by big banks.

Zero Paperwork

The entire process is 100% paperless. All you need is your smartphone and your South African ID.

Total Security

Every transaction is protected by bank-level encryption, ensuring your personal data remains private.

What Exactly is a Payday Loan in the Current Context?

A payday loan is a short-term, unsecured credit facility designed to bridge the gap between your current financial need and your next salary deposit. Historically, these loans were stigmatized, but the modern South African MFO (Microfinance Institution) industry has professionalized the service. Today, it is a regulated, transparent, and highly efficient way to manage short-term cash flow shocks.

Unlike a personal loan or a mortgage, a payday loan is not intended for long-term debt. It is a "velocity product"—it arrives quickly and is settled quickly, usually within 14 to 30 days. This makes it an ideal tool for emergencies such as urgent medical care, school fees, or essential home repairs that cannot wait for the end of the month.

Why Payday Loans are Dominating the SA Market

The rise of digital lending in South Africa is driven by the mobile revolution. With over 90% of the population owning a smartphone, the barrier to financial services has been broken. People in Johannesburg, Durban, or even rural areas of Limpopo now have the same access to capital as a corporate executive in Sandton.

The "Thin File" Advantage

One of the most significant barriers in the South African economy is the lack of a formal credit history. Traditional banks often refuse applicants who have never borrowed before. Payday lenders use Alternative Scoring—analyzing mobile money patterns, utility bill payments, and consistent income flow—to grant credit where others see only risk.

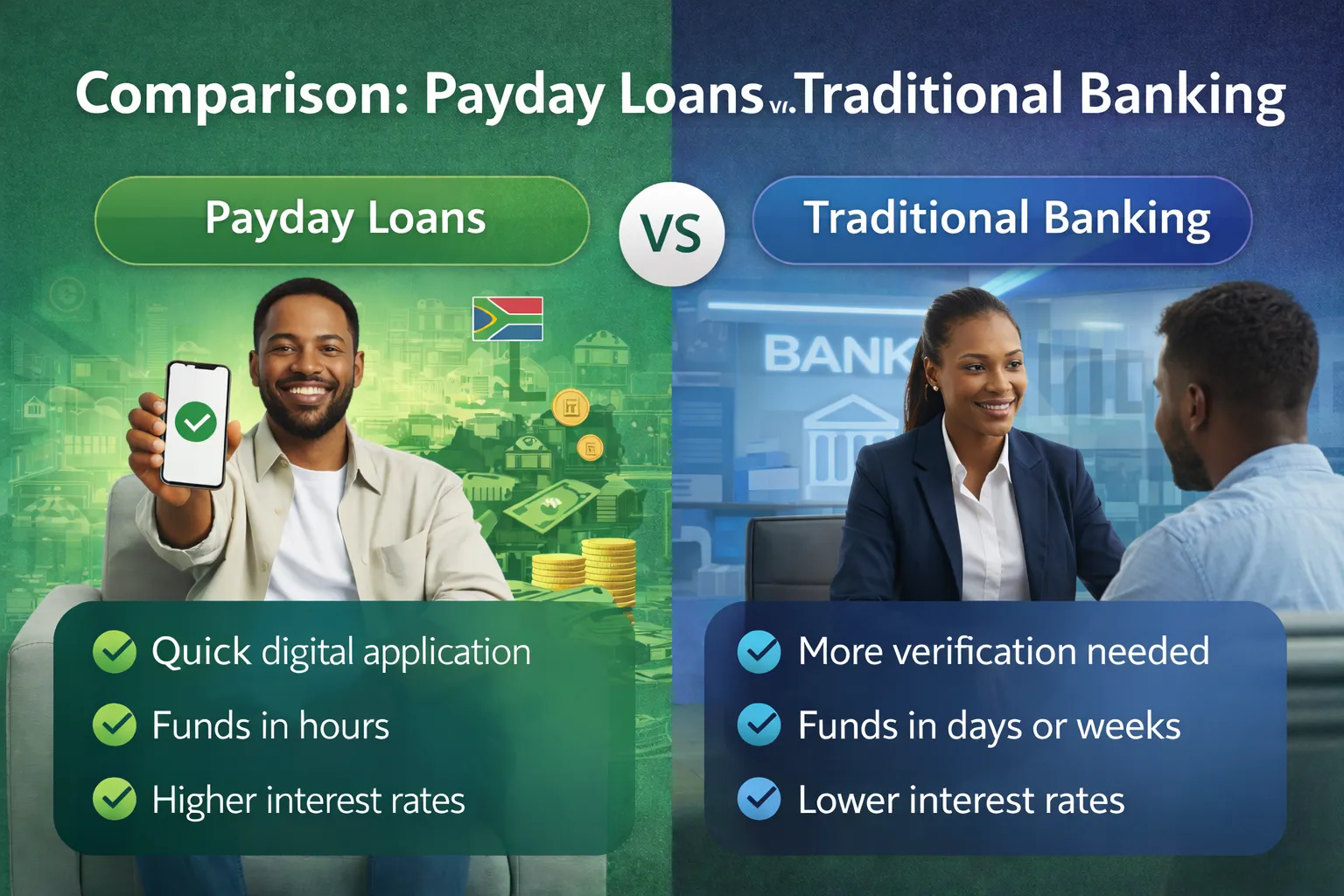

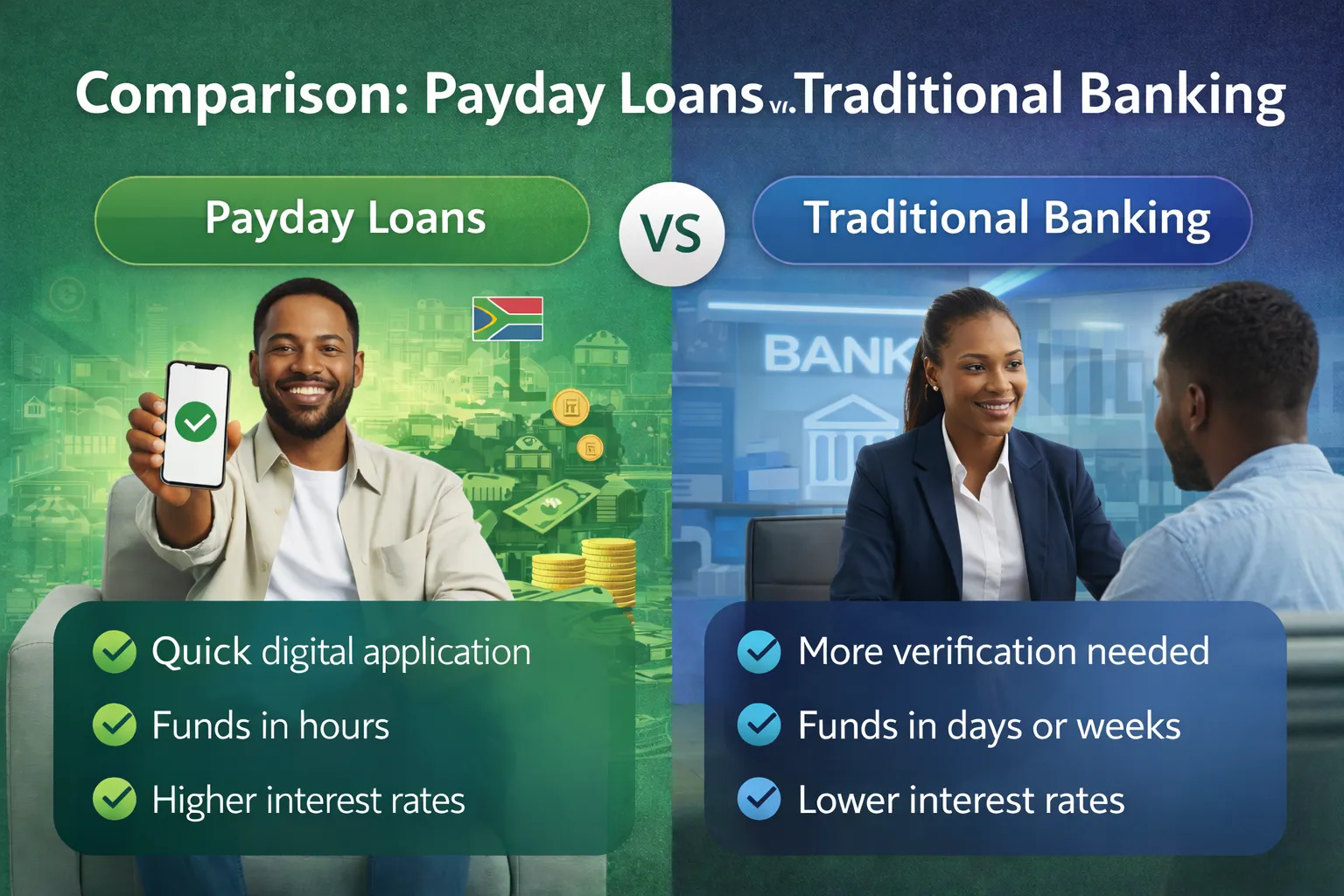

Comparison: Payday Loans vs. Traditional Banking

| Feature |

LadConsulting Digital Loans |

Traditional Commercial Banks |

| Approval Time |

Instant (Under 15 minutes) |

5 to 14 Business Days |

| Collateral Required |

No (Unsecured) |

Often requires assets or guarantors |

| Minimum Credit Score |

Flexible / Alternative Scoring |

Very Strict (High Score Required) |

| Application Method |

100% Online / Mobile |

In-branch visits and interviews |

| Service Hours |

24/7 Availability |

Standard Business Hours |

How the Approval Process Works (Behind the Scenes)

Many customers wonder how an app can decide to lend money so quickly. The answer lies in Machine Learning Algorithms. When you apply, our system securely reviews your provided data points—such as your employment status, income consistency, and debt-to-income ratio. This process removes human bias and allows for a fair, data-driven decision in seconds.

Furthermore, digital lenders are integrated with the National Credit Regulator (NCR) guidelines and Credit Reference Bureaus (CRB). This ensures that while we are fast, we are also responsible, preventing borrowers from taking on more debt than they can realistically handle.

Steps to Secure Your Loan Responsibly

1. Application

Complete the online form with your ID number and banking details for disbursement.

2. Verification

Our AI verifies your income through secure digital channels. No phone calls required.

3. Offer

Review your personalized loan offer, including interest rates and the exact repayment date.

4. Payout

Once you accept, funds are transferred to your account via instant EFT or wallet.

What to Know Before You Borrow

Borrowing money is a professional commitment. Before applying for a payday loan, we advise all our South African clients to consider the following:

- Purpose of the Loan: Is this for an emergency (good use) or a luxury item (bad use)?

- Repayment Plan: Will you have enough funds on your next payday to settle the loan without compromising your rent and grocery budget?

- Interest Rates: Short-term loans carry higher interest rates than long-term bank loans due to the high risk and lack of collateral. Always check the total cost of credit.

The Impact of Late Payments

Missing a payment deadline can negatively impact your credit score, making it harder to get credit in the future. In South Africa, default data is shared with major bureaus. However, if you find yourself in a position where you cannot pay on time, communication is key. Most professional MFOs offer extension options or restructured payment plans if contacted before the due date.

Conclusion: A Tool for Financial Empowerment

Payday loans, when used correctly, are a powerful tool for financial empowerment. They provide a safety net for the hardworking people of South Africa, ensuring that a temporary cash shortage does not turn into a long-term crisis. By choosing a transparent and regulated partner like LadConsulting, you are taking control of your financial destiny with the best technology at your fingertips.

Ready to Get Started?

Apply now and get approved in minutes. Join thousands of South Africans who choose speed and transparency.

Get Your Instant Loan Now